It’s hard to believe but Election Day is less than eleven weeks away. I recently sent an email to our firm’s clients regarding the upcoming election and possible impacts on their investment portfolio.

The goal was to provide some educational information and historical context regarding investing around elections. The information was candidate-neutral and designed to merely provide information on past election years as well as some scenarios for the current election year.

The email (and this post) was largely prompted by questions that I’ve been getting from clients and prospective clients recently: “How will the election impact my investments?” or “Do you recommend making any changes to my portfolio before or after the election?”

Below is what I shared with our clients…

The first piece was developed with our partners at Buckingham Strategic Partners and is titled “Election Year Politics and Stock Market Forecast”. This article highlights the difficulty in forecasting and timing investing around an election. A key takeaway from the article: Trying to time the market due to concerns about the upcoming election is not likely to be a winning strategy.

A second article that we found informative was produced by American Funds. This article titled “Election Watch” looks at several scenarios that could play out in November and the investment implications they could bring. A key takeaway from this article: For long-term investors, the outcome of U.S. presidential elections hasn’t mattered as much as staying invested and maintaining a diversified portfolio.

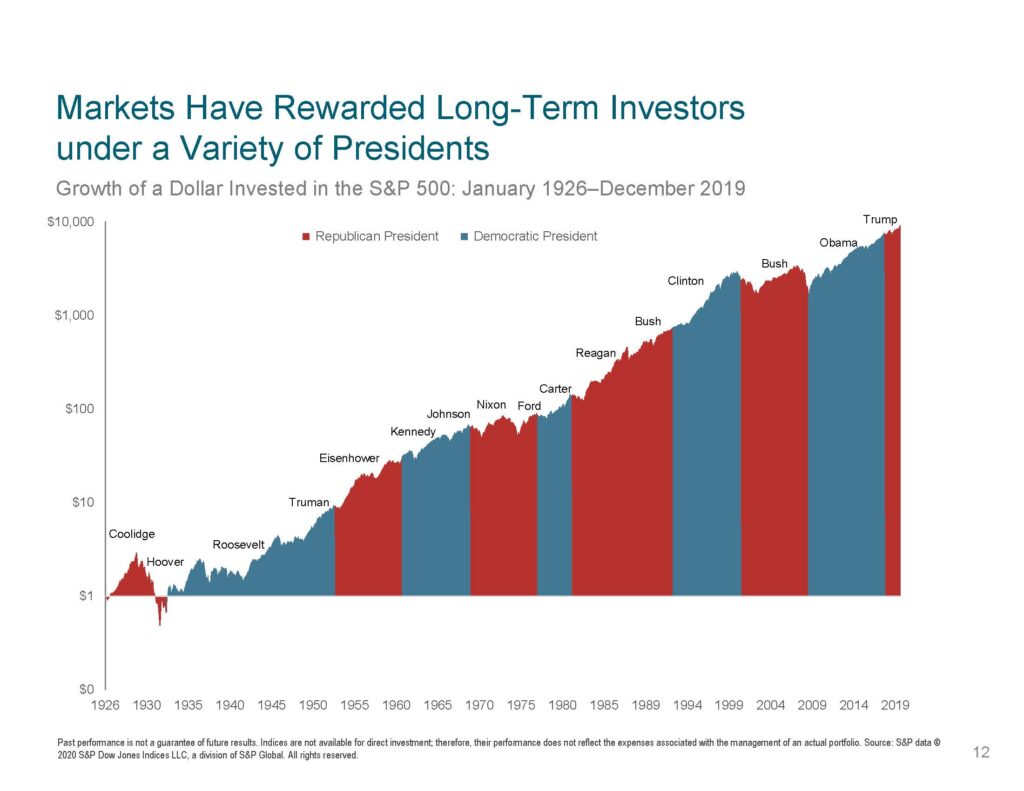

Lastly, we wanted to share a chart, produced by Dimensional Fund Advisors (DFA). It shows the growth of $1 invested in the S&P 500 starting in January of 1926 through December 2019, including the party and President in place during that time period. (chart via DFA)

In summary,

- We advise clients to avoid making short-term changes to a long-term investment portfolio in order to try and profit (or avoid losses) from changes in the political landscape or any other event (i.e. Brexit)

- It’s easy to get distracted by monthly, quarterly or even annual returns but what really matters is your return over the long-term. The markets have historically provided positive returns over the long run regardless of which party is in the oval office.

I suspect you’ll be hearing a lot more commentary on these subjects in the coming months. As long as you have a plan and stick to that plan, you should be fine.

If you like this post, share it or forward it to a friend! They can sign up for my blog posts and emails here.